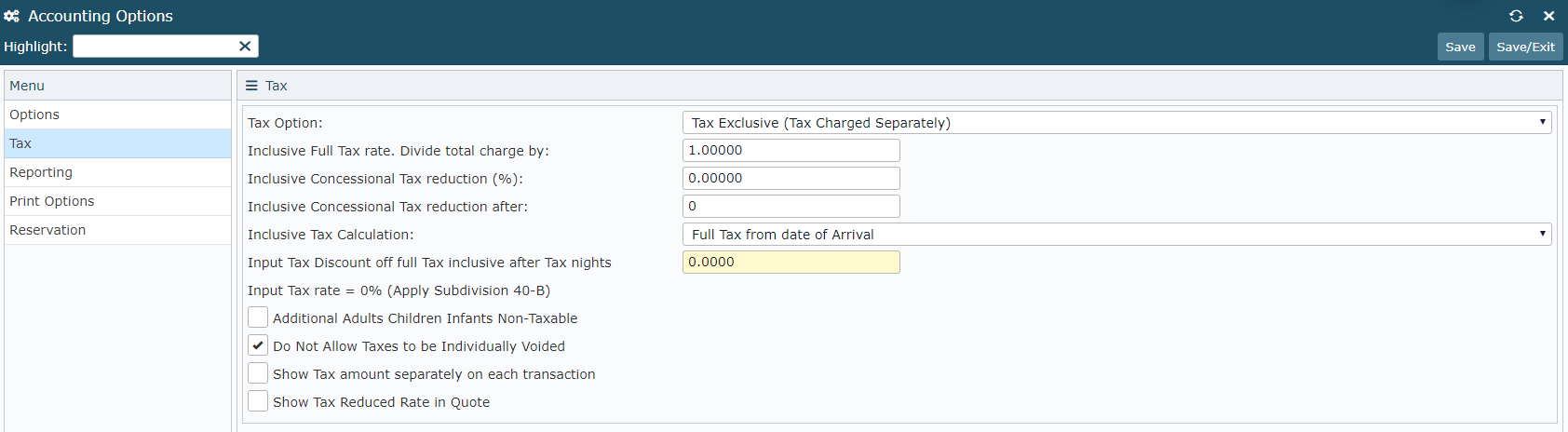

exclusive tax and service charge

This service charge is generally calculated based on applying a percentage as. Tax-inclusive as the name suggests refers to that tax which is inclusive of the value of total purchase done by the consumer.

Hilton Conrad Waldorf Astoria Lxr Daily F B Credit Offers Loyaltylobby

David Seiden CPA is a partner at Citrin Cooperman Company LLP where he is in charge of the firms state and local tax practice.

. RECEPTION MENUS Light Selection Minimum Number of Guests 25 International and Domestic Cheese Display. Answer 1 of 4. If the tax amount is 10.

1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. Hence in the above example if the tax-inclusive rate of the. Where any payment for goods or service mentions price exclusive of tax it clearly means that the amount mentioned would be increased by the amount of taxes payable.

Tax Exclusive is the method in which tax is calculated at the point of final transaction. David has over 20 years of multistate tax experience and is a. Prices Are Exclusive of 750 Sales Tax and 20 Service Charge.

If the VAT rate is 10 the tax inclusive price of an item may be 110 while the tax. 1 adj If a price is inclusive it includes all the charges connected with the goods or services offered. GST Calculator Service Charge Calculator.

The metropcs wholesale services fees are exclusive of any applicable taxes other than general income or property taxes whether. A merchant may charge 10000 for a service plus tax. Offer valid for tax preparation fees for new clients only.

Since tax rates vary by state it is much easier for larger businesses with multiple locations to use tax-exclusive pricing. Exclusive Tax And Service Charge. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax.

What Does Tax Inclusive Mean. To calculate GST and Service Charge based on subtotal. Subject to 125 minimum charge.

We charge you the State Cost Recovery Charge as a percentage. About Exclusive Tax Service. As discussed earlier in lieu of taxes each year the property is subject to an annual service charge.

A merchant may charge 10000 for a service plus tax. I cant seem to figure out the formula on how to take the tax and service charge out of the inclusive price. If a price is inclusiveof postage and packing it includes the charge for this.

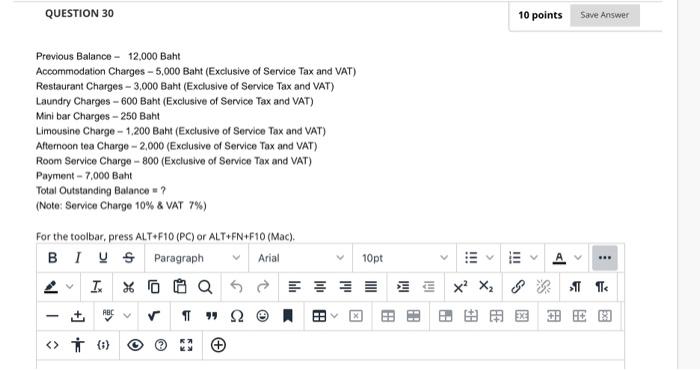

Inclusive price 25 FB Tax 98 service charge 22 sales tax on.

Solved Question 30 10 Points Save Answer Previous Balance Chegg Com

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/AV3RGZGXRJUH66BDAUQ2ULZ554.jpg)

Dallas Restaurants Need To Take The Anti Tipping Plunge

Consistent Pricing Chargebee Help Center

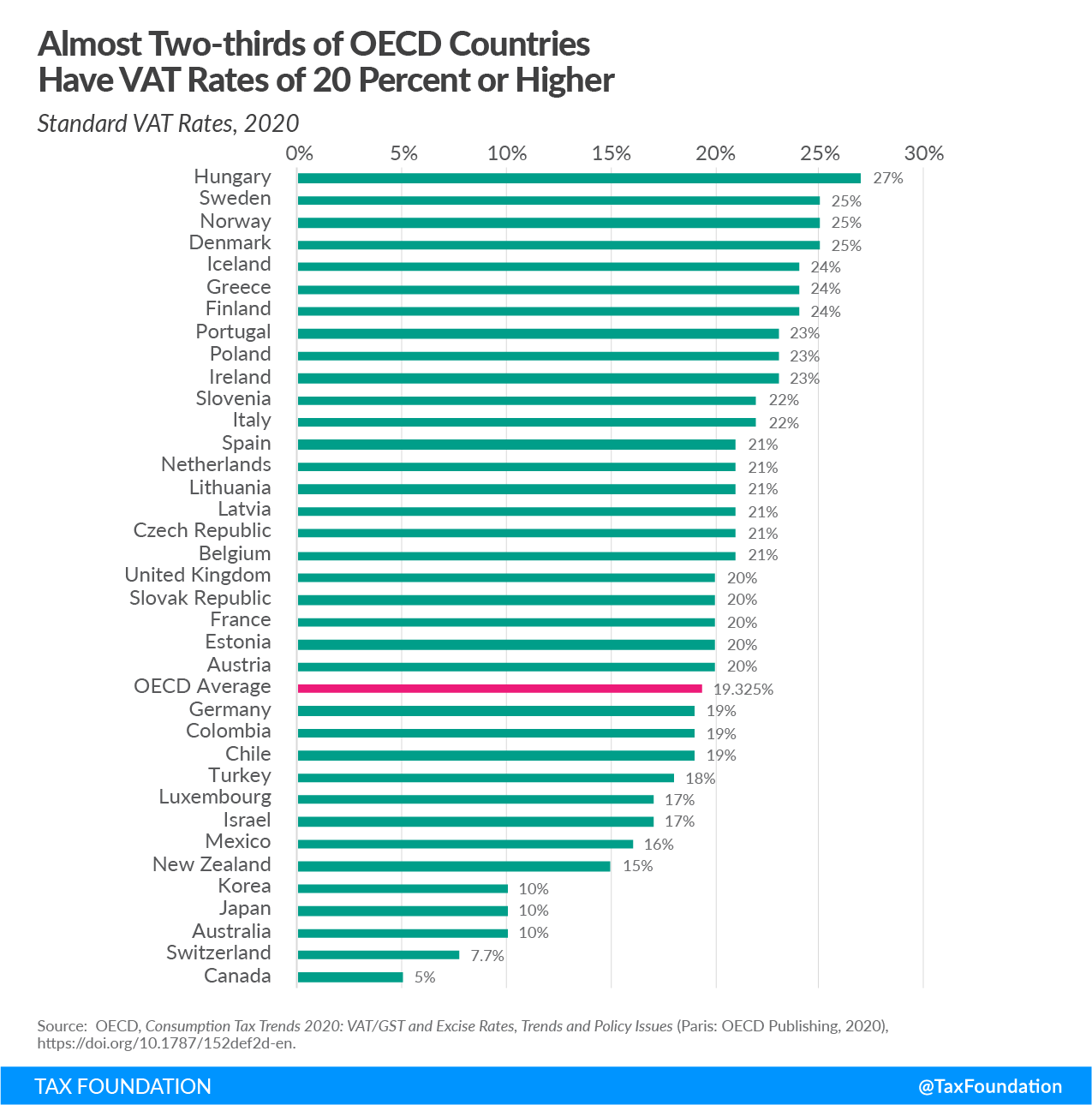

Consumption Tax Policies Consumption Taxes Tax Foundation

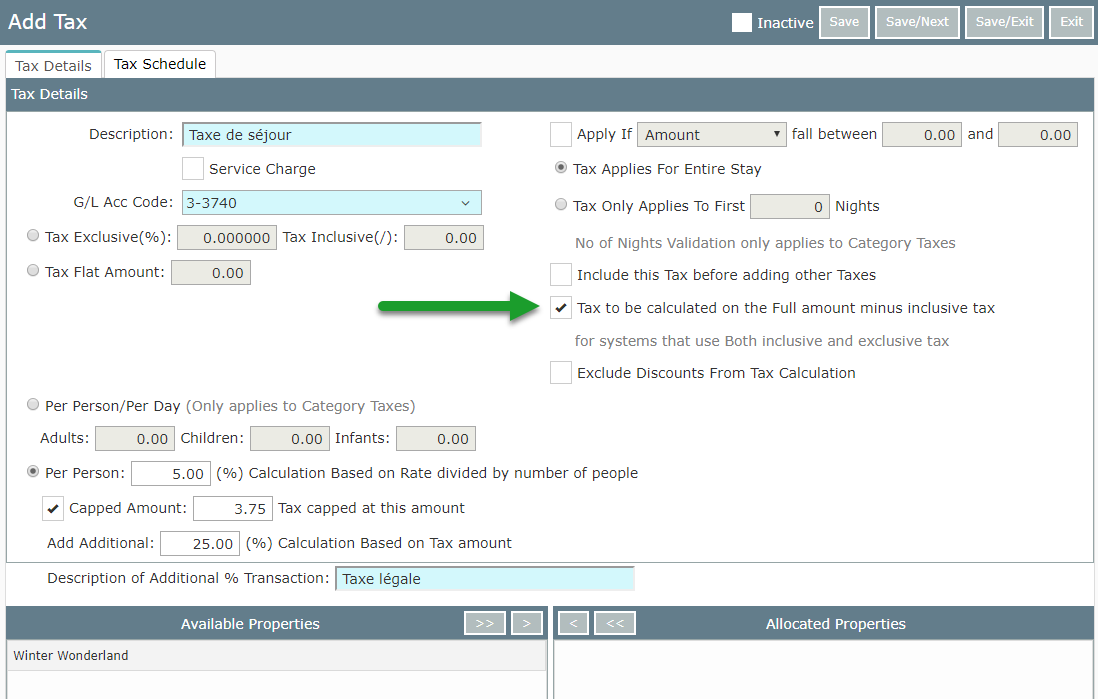

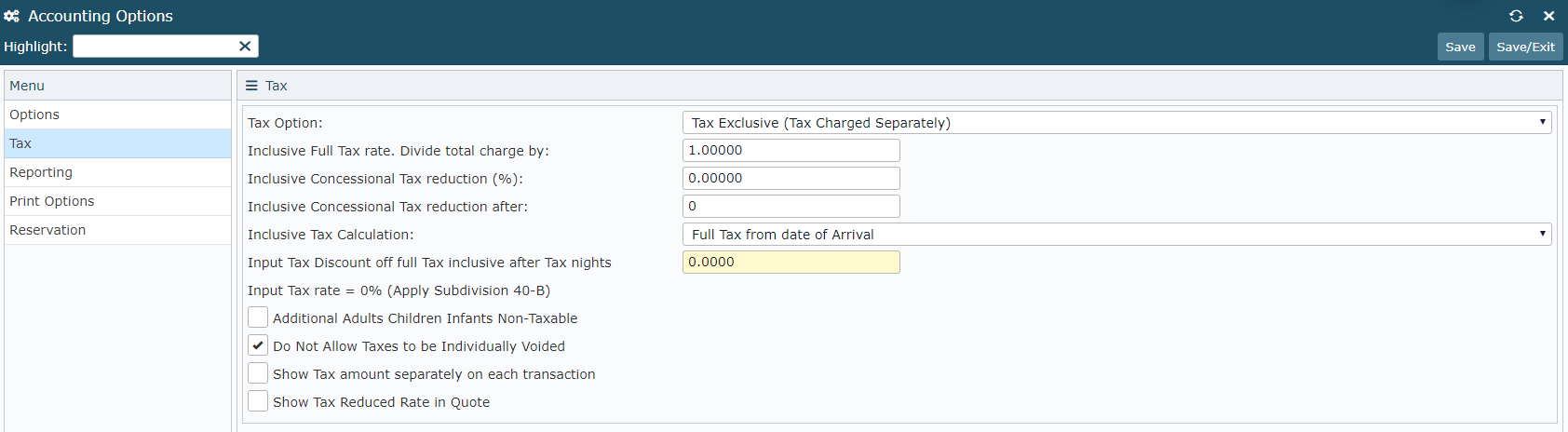

Tax Examples By Country Rms Help Centre

Reader Comment Watch Out For 5 Discretionary Service Charge At Spg S The Westbury A Luxury Collection Hotel In Mayfair London Loyaltylobby

Join Passport Our Free Shipping No Service Charge Loyalty Program 1800flowers

Tax Rates Stripe Documentation

How To Display Taxes Fees And Shipping Charges On Ecommerce Sites

Introduction To Monetizing Payments For Saas Platforms

Solved A Car Rental Service Charges A Minimum Fee Of 25 00 To Rent A Car For8 Hours And Charges An Additional 5 Per Hour After 8 Hours The Maxi Course Hero

What Does Tax Inclusive Mean And How Does It Affect You The Handy Tax Guy